An S Corp is taken into account a go-by means of entity, meaning the business by itself is just not taxed. As a substitute, profits is described around the owners' individual tax returns. Businesses taxed as C Corporations are not pass through entities. Earnings is taxed at the corporate degree, and, if dividends are distributed, at the person degree too. By deciding upon a company or LLC with Inc Authority, you are able to choose an S Company as your tax filing position. You have got 75 times soon after formation to file this designation Together with the IRS. Return to site

LLCs are well-liked for entrepreneurs and groups seeking to start a promising new business undertaking. Some prevalent reasons why folks elect to form LLCs incorporate:

Although Each and every LLC is necessary to possess a registered agent, it can be done to work as your very own agent or appoint an LLC member into the part. Otherwise, you might hire someone or company to work as your agent.

Even though it's completely feasible for proprietors of just one-member LLC to create their own operating agreement, It can be ordinarily best to consult an experienced business lawyer when coping with multi-member LLCs.

However uncommon, It is attainable to form an LLC for non-profit applications. A key distinction with such a LLC is that they are permitted to earn a profit, but that revenue has to be reinvested to the company or in any other case accustomed to even more the company's charitable objectives.

Whilst one-member LLCs with no personnel can technically make use of the member's Social Stability number in place of an EIN, a lot of monetary establishments request an EIN when opening a business checking account.

Users of this site may also take a look at if they want to accomplish an EIN number software free of cost on their own, having said that they aren't eligible for assistance or even a simplified application process from us. Lawful Details & Disclaimer:

When you decide to hire workers for your LLC, you will need to observe these authorized compliance necessities:

But an LLC offers a number of advantages, like protection as somebody from legal and economic troubles that your company may possibly experience.

A sole proprietorship is considered the most simple means of business Procedure. In this case, an individual engages in business without establishing a formal Group.

Confirm the categories of licenses and costs your business wants LLC Radar California to function lawfully in your state. Be mindful of important deadlines, as you will likely should apply to resume your license or allow periodically.

Incorporates Simple package deal, moreover: An operating agreement, which helps you set entity suggestions and settle disputes An EIN, which happens to be used to file taxes, open financial institution accounts, and build your workers Access to over one hundred fifty customizable legal documents and limitless eSignatures for just one calendar year First phone consultations with experts about business coverage and taxes Build your LLC Consists of Simple bundle, in addition: An operating agreement, which helps you established entity guidelines and settle disputes An EIN, that's accustomed to file taxes, open bank accounts, and build your employees Usage of more than a hundred and fifty customizable lawful documents and limitless eSignatures for a single yr First phone consultations with specialists about business coverage and taxes I want advice from experienced attorneys Quality

Additionally they lack the pliability to choose from operating as a pass-by means of business entity or as a corporation. A sole proprietorship could be a good starting position for a person, but they could later on take into account creating a single-member LLC.

Failing to meet renewal prerequisites could bring about your LLC to shed its position to be a lawfully recognized business.

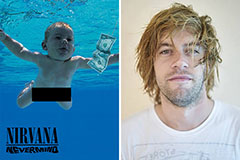

Spencer Elden Then & Now!

Spencer Elden Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!